Halfway through what has been dubbed the “decisive decade” for climate action, the energy transition has passed an inflection point. It is now a structural feature of the global economy, reshaping markets worldwide. Given the inevitability and opportunity of the transition, the value that will accrue to those who offer solutions is immense, however, success in this space demands more than traditional investment acumen. We believe the transition will reward those with a deep and nuanced understanding of how climate science, technology, politics, policy, and markets will intersect and evolve.

Galvanize sees returns and impact as inextricably linked. We cannot manage—and cannot generate value from—what we cannot measure. Our Impact Platform is a core driver of our investment strategy because we believe it sharpens our competitive edge; allocating resources and expertise toward impact assessment and acceleration makes us better investors. Moreover, our experience has shown that deep integration of these resources within each of our investment strategies enhances our ability to identify opportunities, manage risks, and create lasting value.

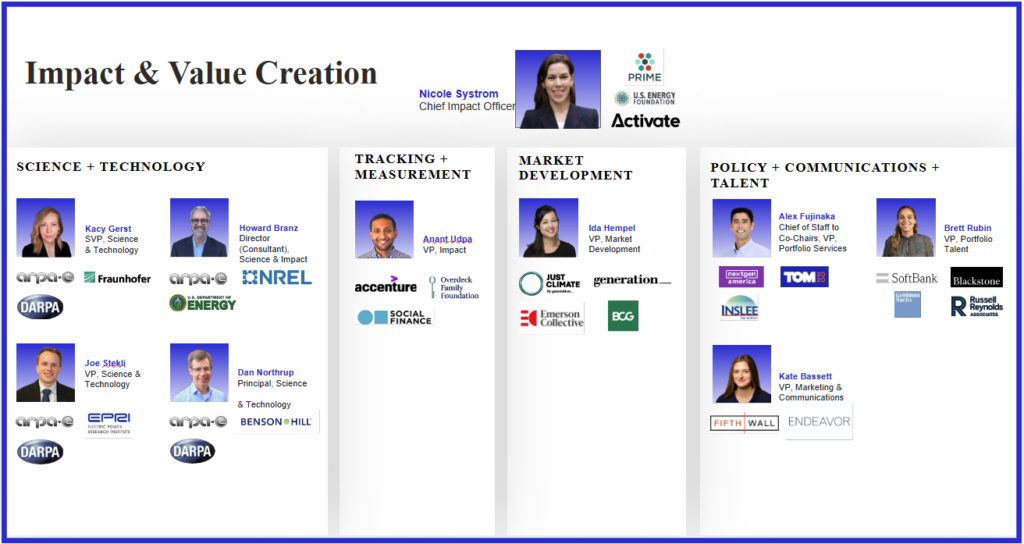

The Galvanize Impact team serves as the intelligence hub of the firm, enhancing our investment process with interdisciplinary expertise spanning climate impact, technology, talent, market development, communications, policy, and politics. Drawing from leadership roles at leading institutions including Advanced Research Projects Agency–Energy (ARPA-E), Department of Energy (DOE), National Renewable Energy Laboratory (NREL), Generation Investment Management, Prime Coalition, Fifth Wall, SoftBank, and more, the Impact team brings decades of collective experience across these domains.

At its most basic, the team’s focus is twofold:

- Impact assessment: Helping our investment teams articulate their intended impact, embed impact considerations into their investment processes, and ensure our investments, strategies, and firm are focused on issues that truly matter for the climate.

- Impact acceleration: Providing comprehensive support to position our investments for accelerated commercial success and scaled impact, while driving market adoption of climate solutions through strategic ecosystem initiatives.

However, this work manifests differently across each of our strategies, with distinct approaches for Galvanize Real Estate, Innovation + Expansion, and Galvanize Global Equities. It also varies throughout the investment lifecycle—from initial strategy development to due diligence and post-investment support. Rather than taking a one-size-fits-all approach, we tailor our impact methodologies and support to maximize effectiveness for each unique context.

We believe our unique impact approach is best explained by example. In the coming weeks, we’ll be sharing a series of blog posts that delve deeper into how our Impact team operates across different asset classes and investment phases, sharing case studies of how Galvanize’s Impact Platform drives financial returns alongside meaningful climate progress.

Stay tuned over the next three weeks as we share:

- How impact informs our investment strategies

- How we approach the pre-investment impact process

- How we approach the post-investment impact process