At Galvanize, we believe the hallmark of a good impact measurement and management system lies in the extent to which it actively guides investment decision-making. Impact assessment is not a peripheral exercise for us; it is integral to each strategy’s investment process and deeply entwined with financial and operational due diligence.

Impact considerations are an important part of our Investment Committee meetings and often spark vigorous discussions as we grapple with the climate impact potential of a given opportunity and critically examine our ability to add value. By how much are AI-related data centers likely to contribute to US load growth? What are the technological trade-offs among the leading production pathways for sustainable aviation fuel? How should energy storage assets be sited and operated on the grid to maximize GHG reductions? These deliberations have led us to make challenging but principled decisions, including passing on particular investments or investment themes on occasion when they fail to meet our impact criteria.

The Galvanize Impact team’s pre-investment partnership looks different for each strategy, but focuses on two core dimensions:

- Climate impact assessment

We typically ask: Does this investment meet our climate-related eligibility criteria for this strategy? How might this investment advance or benefit from the energy transition? What are the pathways and timeline by which it could lead to real-world climate impact, and what risks or opportunities might this investment face in achieving this impact? How much impact do we estimate this investment will have and in what timeframe? The Impact Team designs tailored pre-investment impact processes for Galvanize strategies to help answer and elevate these questions early in the decision-making process.

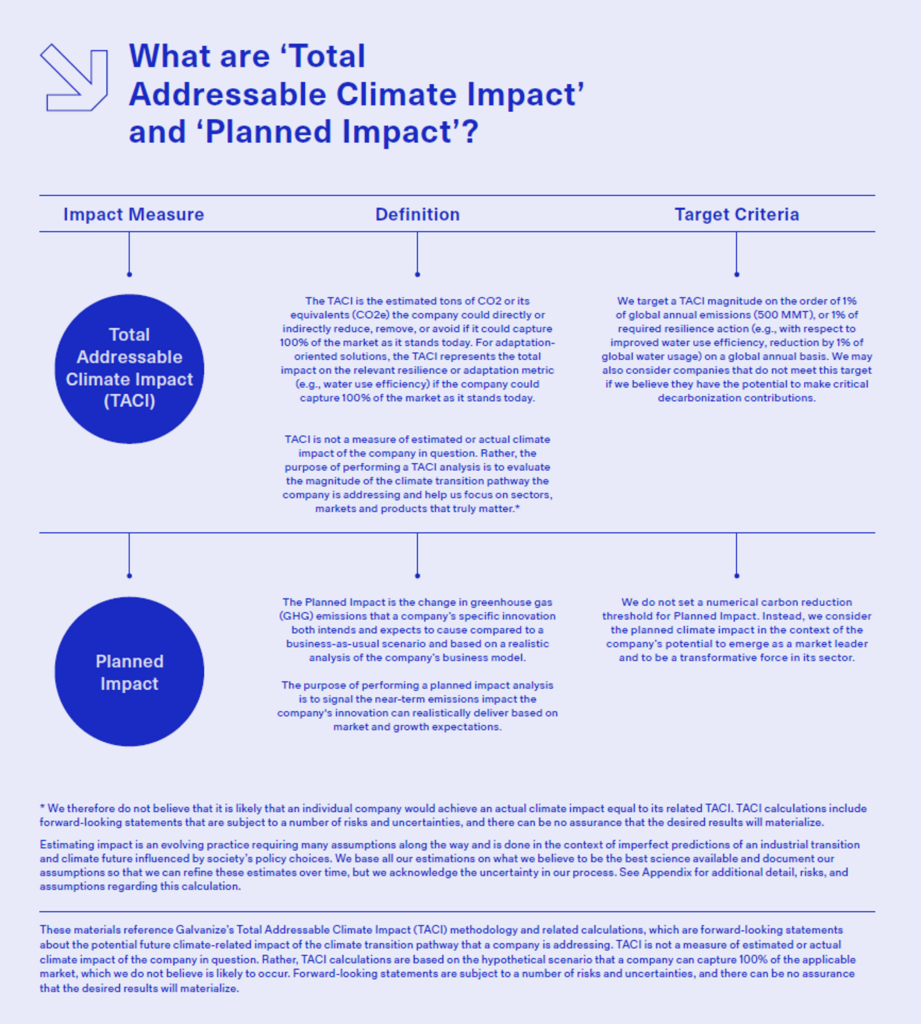

For example, the Innovation + Expansion (I+E) process starts by articulating a theory of change for each company along with any significant impact-related risks or opportunities the solution might face. In tandem, we perform an outside-in quantitative analysis of the company’s potential impact. Drawing on available materials and the Impact team’s experience, networks, and expertise, we estimate the “Total Addressable Climate Impact (TACI)”1 of the company to ensure its solution presents material emissions reduction potential. As the company advances through diligence, we also perform a “Planned Impact” analysis based on deployment projections over time, to evaluate the climate impact the company’s innovation could realistically deliver based on market and growth expectations. The combination of these top-down and bottom-up impact models helps us pressure test both the overall scale of the climate challenge the company is addressing, and the fraction of that scale the company’s solution is likely to influence.

- Technical assessment

Given the rapidly evolving climate solution landscape, we believe rigorous technical assessment can provide a competitive edge for differentiating between real and perceived risk and identifying scalable opportunities with meaningful climate impact potential. The Galvanize Impact Platform’s Science & Technology (S&T) Team, made up of veterans from leading institutions like ARPA-E, DARPA, NREL, DOE, and EPRI2, brings decades of specialized domain expertise—spanning grid solutions, power electronics, electric vehicles, sustainable aviation fuels, chemicals, building systems, biological and agricultural technologies, and more—to the pre-investment decision-making process.

The team regularly screens ~60-70 investment opportunities each month, performing in-depth technical due diligence on a smaller subset. At the strategic level, S&T continuously monitors emerging academic research and technology development trends, conducting thematic landscape studies to identify promising sectors and sub-sectors for investment. These analyses directly support our investment teams to develop strategic theses around key decarbonization or adaptation bottlenecks and opportunities.

At the investment level, S&T’s support differs by investment strategy and deal-specific context. For Real Estate (GRE), it might include physical walkthroughs of potential properties to evaluate building and mechanical conditions and the potential for on-site generation, electrification, and/or energy efficiency measures. With Global Equities (GGE), it may include evaluating a prospective portfolio company’s unique technological advantages and broader energy transition-related trends or tailwinds on which the company could capitalize. S&T also conducts early technical assessments for select companies to help scope the total addressable market for climate- and energy-related products and inform the assessed corporate value and price. For I+E, S&T applies its technoeconomic expertise to evaluate both the technical and commercial viability of potential solutions. Conducting these technical assessments early in I+E’s diligence process helps efficiently focus the investment team’s resources on solutions that are economically feasible and scalable, with low or manageable technological risk.

——

Case Study: I+E Technical Assessment in Action

In January 2023, S&T conducted technical due diligence on a prospective I+E company developing permanent magnets for electric vehicles and wind turbines.

Drawing on its expertise in mechanical systems, the team specifically requested performance data on the products’ resistance to demagnetization—a metric that to our knowledge had not been requested by other potential investors in the syndicate. Our analysis found that while the company’s magnets exhibited impressive strength, they were vulnerable to demagnetization, making them unsuitable for the intended applications.

When the company proposed adding a rare earth element to address this limitation, our established relationships and consultation with US Department of Energy experts allowed us to quickly verify that this approach would not resolve the underlying technical challenge. These insights led us to ultimately decline the sizeable investment opportunity. Two years later, the company has yet to produce magnets that meet the performance requirements to drive electric vehicle motors or wind generators and thus successfully compete with existing market alternatives.

——

The Galvanize model blends investment rigor with the deep climate expertise of our Impact Platform. The pre-investment impact processes described above seek to position our investment teams to make highly informed bets, grounded in thorough climate impact assessment and technoeconomic analysis. By authentically integrating impact considerations into investment decision-making, we aim to more efficiently channel our focus, capital, and resources toward sectors, markets, and solutions that matter for the climate.

For the final installment in this series, we’ll dive deeper into our post-investment impact process and how harnessing the full capabilities of the Galvanize Impact Platform amplifies the climate impact, growth, and value creation of our investments.

——

1 The TACI is the estimated tons of CO2 or its equivalents (CO2e) the company or other investment could directly or indirectly reduce, remove or avoid if it could capture 100% of the market as it stands today. For adaptation-oriented solutions, the TACI represents the total impact on the relevant resilience or adaptation metric (e.g., water use efficiency) if the company or other investment could capture 100% of the market as it stands today. TACI is not a measure of estimated or actual climate impact of the company or other investment in question. Rather, the purpose of performing a TACI analysis is to evaluate the magnitude of the climate transition pathway the company is addressing and help us focus on sectors, markets and products that truly matter. We therefore do not believe that it is likely that an individual company would achieve an actual climate impact equal to its related TACI. TACI calculations include forward-looking statements that are subject to a number of risks and uncertainties, and there can be no assurance that the desired results will materialize.

2 Advanced Research Projects Agency-Energy (ARPA-E), Defense Advanced Research Projects Agency (DARPA), National Renewable Energy Laboratory (NREL), Department of Energy (DOE), Electric Power Research Institute (EPRI).

These materials reference Galvanize’s Total Addressable Climate Impact (TACI) methodology and related calculations, which are forward-looking statements about the potential future climate-related impact of the climate transition pathway that a company is addressing. TACI is not a measure of estimated or actual climate impact of the company in question. Rather, TACI calculations are based on the hypothetical scenario that a company can capture 100% of the applicable market, which we do not believe is likely to occur. Forward-looking statements are subject to a number of risks and uncertainties and there can be no assurance that the desired results will materialize.