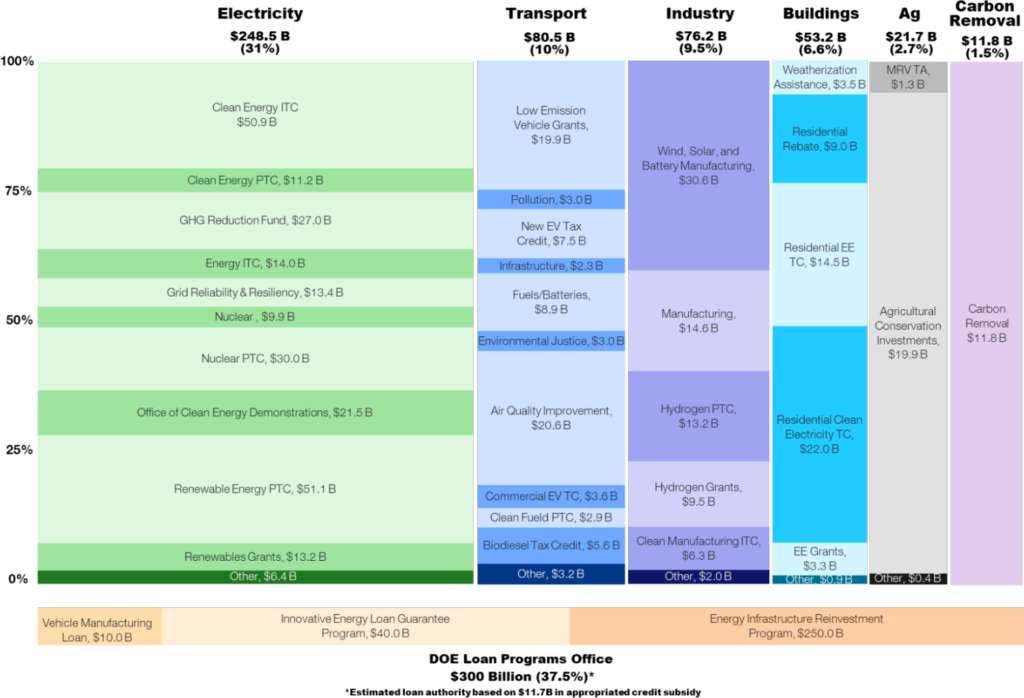

Estimated $800 Billion in Total Available Funding from IRA & IIJA

Source: Original Analysis by Jun Shepard (RMI) and Lachlan Carey (RMI)

As the bulk of these grants and incentive programs roll out over the next couple of years, we wanted to lay out our expectations of the resulting impacts.

- The IRA is here to stay

As a result of the GOP regaining control of the House in 2022 and the fluid American political environment of the foreseeable future, we are constantly asked about how a shift of control in DC could impact the implementation of the IRA and IIJA. To answer this simply: they are here to stay. Unlike the bulk of Obama-era climate policy that was enacted via regulation, and vulnerable to Trump-era rollback efforts, the IRA is legislation. Repealing the IRA would require completely new legislation to be passed. This is not a realistic outcome as the investments the IRA is making are widely popular, with roughly ⅔ of the major projects announced to date located in Republican-held districts. Additionally, with climate-friendly Democrats controlling the executive branch for at least two more years, agencies – like the EPA, DOE, USDA, and Treasury– will continue to be managed by leaders working to push out funds as quickly as possible. And after two years of implementation, even if control of the executive branch and its agencies changes hands, walking back implemented programs and investments would be extremely challenging.There is no doubt that over the next two years we will see increased noise coming from DC, with oversight and political scrutiny of climate programs being a key focus of House Republicans. But ultimately this noise will likely not change the fundamental policy support signal or the runway for the expedient implementation of the IRA and IIJA programs. - Tip of the iceberg

$800 billion in federal spending and credits is a historically huge investment, but it also undersells the magnitude of what the IRA and IIJA will bring to bear. The true value of these laws is their ability to jumpstart vital private sector investment – Credit Suisse estimates that the IRA alone could result in nearly $1.7 trillion in public and private spending over the next 10 years.We are already seeing this play out in a major way. In the six months since the IRA was signed into law, companies have announced over $40 billion in new clean energy investments. Last month, Korean solar company Qcells announced it will invest more than $2.5 billion to build factories in Georgia, and in August, First Solar announced it will spend $1.2 billion to expand its manufacturing operations in the U.S., something it said prior to the IRA’s passage that it would likely never do. This is likely just the beginning. According to the International Renewable Energy Agency (IRENA), we need to invest $4.5 trillion in decarbonization globally each year for the next 30 years to limit warming to 1.5C. $1.7 trillion over 10 years is a huge and critical investment, but much more is still needed. - A new era of American industrial policy

The IRA and IIJA represent a new, ambitious era in American climate policy. While it’s still unclear what policies will emerge as a result of this shift in American climate tech competitiveness, through the noise it seems likely that we have entered a race to the top in global climate industry policy.For anyone paying attention to news coming out of this year’s Davos conference, it’s evident European policymakers in particular are paying attention to the United States’ shift, with much talk of protectionism and a potential trade war. The Europeans feel the pressure and in this yet untold policy story, there continues to be increased political and policy support for greater climate investment and financing, much of which could take shape as non-dilutive capital. If this does indeed play out, it will be a major win for climate-aligned businesses and for the planet. - The Loan Program Office has the potential to be an innovation gamechanger

While the IRA includes substantial funding for more established industries that have already gained significant traction as part of the climate transition — like renewable energy, zero emission transportation, and green manufacturing — a reinvigorated Loan Program Office (LPO) at the DOE has the potential to be an innovation gamechanger. As a result of the IRA, the LPO now has the authority to loan over $350 billion to support energy and transportation projects. Because these funds are technically loans and not grants, this $350 billion is not included in the topline IRA numbers. Through its suite of programs, the LPO can fund projects with a higher risk profile than most investors are willing to accept, providing capital to companies at the innovation frontier. - The priority for the next 12 months is setting the rules of the road

Because the IRA was passed through reconciliation, many of the rules required for implementation are still under development. Had the IRA gone through two years of committee reviews and emerged with stringent instructions for agencies and regulators, the implementation process would be far more straightforward. As a result, the forthcoming efforts to establish rules to distribute these funds will be critically important. The very agencies charged with implementing the IRA–like the EPA, DOE, USDA, and Treasury– are currently putting together rules of the road to extract maximum impact, with feedback from the broader community.We, at Galvanize, are closely watching the guidance the administration is releasing on IRA implementation – it is a critical time for those in the climate and climate investment space to engage. If done correctly, the IRA could be the most powerful tool ever enacted in the United States to fight the climate crisis. Now is the time to get it right, and unleash the power of American innovation and the American private sector.