In our previous posts, we explored how impact assessment shapes our investment strategies, informs our sourcing and due diligence processes, and sharpens our focus on solutions where climate impact creates competitive advantage. However, this represents only one half of our Impact Platform’s mandate. Post-investment, our focus shifts from impact assessment to impact acceleration, providing differentiated support to position our investments for accelerated commercial success and scaled impact.

While our post-investment approach varies by strategy, it generally operates on two parallel and complementary tracks: direct support for portfolio companies and investments, and broader ecosystem development to help create the enabling conditions for climate solutions to scale.

Direct Supports:

Investment-level impact acceleration objectives and select examples include:

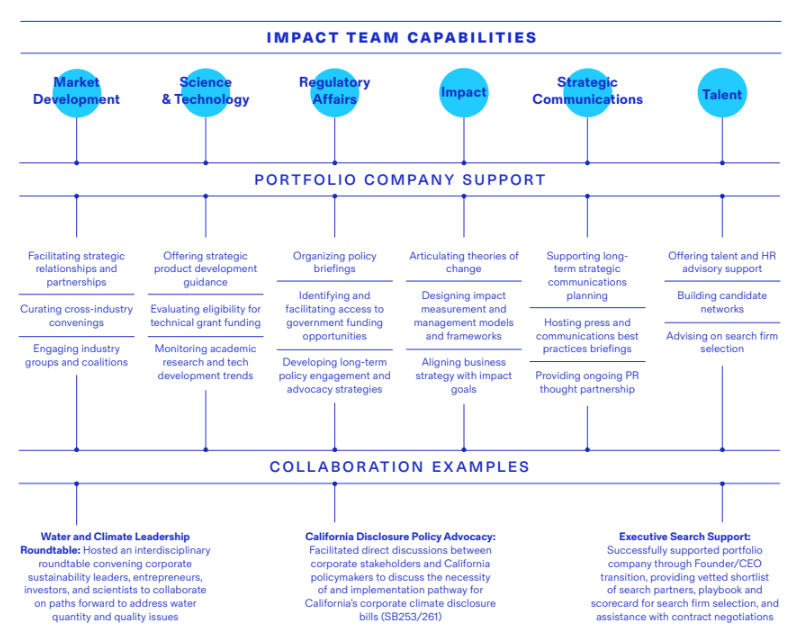

- Scaling our companies and investments by accelerating demand for climate solutions and positioning our portfolio companies to win in their categories. We draw on the Impact Platform’s interdisciplinary team—spanning science and technology, talent, market development, impact measurement, communications, and policy—to deliver differentiated resources with the goal of driving outsized value, and therefore climate impact, for our companies and investments.

Example: For Innovation + Expansion (I+E), our Impact team partners with portfolio company management on high-leverage strategic projects where we believe Galvanize can add significant value. This support is tailored to each investment’s specific needs and market context. Recent examples include successfully supporting a portfolio company through a Founder/CEO transition, advising a company on crisis communications, and hosting a series of interdisciplinary roundtables on topics ranging from how to address water quantity and quality issues stemming from climate change to how to scale high-performance company culture.

- Tracking progress against our desired climate impact and conducting active performance management. The practice of impact measurement and management is foundational to our work. It not only provides transparency to our investors and holds us accountable to our mission, but it also helps us manage risks and prioritize post-investment value creation. Examples:

a. For Real Estate (GRE), the Impact team has designed systems to sweep and aggregate utility bill data across properties, allowing us to regularly monitor energy use, its associated emissions, and other sustainability metrics across the portfolio. The Impact team works alongside GRE Asset Management to review and benchmark performance, identify optimization opportunities, and measure actual impact against our initial underwriting assumptions.b. Across our strategies, we have also established Net Zero pledges aligned to leading standards like the Net Zero Asset Managers initiative (NZAMi), Net Zero Investment Framework (NZIF), Science Based Targets initiative (SBTi), and Venture Climate Alliance. These commitments drive us to measure and neutralize our firm’s operational emissions, while encouraging and supporting portfolio companies to establish and achieve their own climate targets over time through direct engagement and technical assistance.

Ecosystem Initiatives:

Systemic impact acceleration objectives and select examples include:

- Building market demand and policy pull for climate solutions through industry and policymaker education on the business case for climate action. We work to accelerate broader adoption of climate solutions and best practices through strategic industry engagement and thought leadership.

Example: In recent portfolio company engagement meetings, our Global Equities (GGE) team identified a shared challenge around Scope 3 emissions measurement and reduction. In response, GGE worked with the Impact Team to convene a Supply Chain Climate Leadership roundtable in New York City earlier this year, bringing together GGE and I+E portfolio companies, standard setters, market participants, and innovators on this topic. The session facilitated knowledge-sharing on practical approaches to measuring and accelerating value chain decarbonization. Participants raised a range of considerations including evolving standards, tangible business benefits, the emerging role of technology, and the need for industry collaboration. Building on these insights, the Impact team developed and published a white paper, “Bias to Action over Accounting” providing guidance on Scope 3 measurement and offering a framework for companies to pragmatically prioritize decarbonization while creating business value. - Shaping best practices and compliance standards for corporate procurement and asset decarbonization. We aim to play our part to evolve industry best practices and standards for impact measurement, disclosure, and engagement, and foster a collective commitment to accelerate the global transition to Net Zero. As the case study below illustrates, our work combines practical insights from portfolio companies with research partnerships to develop actionable frameworks.

—

Case Study: The Missing Link: Aligning Executive Compensation with Climate Action

Many companies have made voluntary pledges in recent years to reduce their GHG emissions and approximately half of the world’s largest 2,000 companies have established Net Zero targets.1 A promise to reduce emissions, however, does not necessarily mean that management teams have the appropriate incentives to develop the plans and make the strategic, operational, and capital changes needed to drive the Transition. Getting companies to acknowledge there is a need to change behavior was yesterday’s battle. We believe the focus must now be on driving adherence and ensuring that corporate behaviors are evolving urgently to deliver on these longer-term targets.

In light of this challenge, GGE partnered with the Stanford Graduate School of Business (GSB) to analyze corporate governance levers to drive adherence. Our recent white paper, “The Missing Link: Aligning Executive Compensation with Climate Action” explores the importance of executive compensation as a lever to drive corporate behavior by reviewing analogous issues and the efforts of several large corporations as they try and solve this challenge amidst changing regulatory, accounting, and technological conditions.

Specifically, Galvanize and Stanford GSB identified five key foundational pillars that characterize a leading corporate sustainability compensation scheme: 1) alignment with the Paris Accord; 2) granularity in the multi-year initiatives that result in Net Zero by the committed date; 3) transparency in sharing current capabilities, future business plans, and how these might map to targets; 4) linkage to a material portion of the executive’s compensation (best if created as a portion of the long-term incentive plan (LTIP), earned and paid out on an annual basis); and 5) adaptable to reflect the changing nature of a company’s business and ‘baseline’.

In sharing “The Missing Link” with portfolio companies, GGE has found them to be receptive and eager to use the framework as the basis for further discussion. The reality is that most corporate sustainability leaders and boards are already thinking about these issues due to regulatory imperatives and because they are aware of the commitments their companies have made. We have found that companies are excited to explore this subject further with a shareholder who is focused and well-versed on climate issues as well as their more general corporate objectives. It is our view that, as industries evolve, the companies who are front-footed in meeting their climate pledges will tend to be those that establish credible plans and meaningfully align long-term incentives against them.

—

Through this series on the Galvanize Impact Platform, we have aimed to demonstrate:

- How we view our emphasis on impact assessment and acceleration as a source of competitive edge (see The Galvanize Impact Platform: Sharpening our competitive edge);

- How impact and intentionality influence the early design of our investment strategies (see The Galvanize Impact Platform: How Impact enhances strategy); and

- How we integrate impact across the investment process from pre-investment due diligence (see The Galvanize Impact Platform: Enhancing pre-investment decision-making) to post-investment value creation to identify opportunities, inform decision-making, manage risks, and accelerate scaled impact.

We look forward to continuing to report on Galvanize’s evolving impact approach and our progress towards our climate mission. To learn more about the Galvanize Impact Platform, please reach out to us at [email protected].

—

1 “Net Zero Stocktake 2023.” Net Zero Tracker, 11 Jun. 2023, https://zerotracker.net/analysis/net-zero-stocktake-2023.