Recently at Galvanize’s annual Solutions Summit, I had the privilege of delivering a presentation alongside Johan Rockström which explored the dual narratives driving the energy transition. While it’s true that the health of the natural world is worse than projected, at the same time the energy transition is barreling forward faster, and with greater staying power, than most people realize. In other words, while there is urgency to address accelerating climate impacts, mitigation and adaptation are possible, and the opportunities arising from technological innovation and economic restructuring are exponential.

For those not familiar with his work, Johan Rockström, director of the Potsdam Institute for Climate Impact Research. His scientific assessments and articulations of the state of the climate provide an approachable framework through which my investment-focused mind can understand the data from the natural world. Put simply, he’s really good at explaining what’s happening in a way that non-scientists can understand.

And while Rockström is better than anyone else at piecing together the world’s scientific, ecologic, and climate systems to explain the observed and projected impacts on Earth’s physical systems, I’ve built my career on pulling together a comparable array of inputs to determine where the world’s economic systems are headed.

As an investor, a key part of being successful is accurately predicting where the world is headed. Whereas most of us typically only read about climate change’s physical impacts – think skyrocketing sea surface temperatures, record-breaking ice mass loss, and extreme weather events – I also think about the energy transition in terms of numbers, dollars, and market signals.

When I think though my assessment of the future, informed not only through my work as an investor but also through conversations with countless peers and leaders across the climate ecosystem, I believe there is a widening gap between where we are likely headed and where people think we are. In my view, the narrative we as Americans (and frankly, most of the rest of world) hear is skewed. It’s one that says American energy security and economic prosperity is solely dependent on pumping more oil and gas, completely ignoring renewables (or even worse, presenting them as the problem). From where I sit, these narratives are wholly detached from reality and do not consider the data points that come across my desk everyday as an investor.

It is in this spirit that I teamed up with Johan to piece together a presentation which we used to kick off Galvanize’s annual Solutions Summit – one we feel paints a more balanced perspective of the state of the natural world and the progress of the energy transition in tandem. We took a good hard look at the climate science, with Johan sharing the data from the natural world as it stands in 2024, combined with the four leading indicators that tell me, an investor, that the transition is accelerating faster than we realize, with new technologies beating out old commodities in the marketplace every single day.

I’ll do my best to summarize the key takeaways in the following paragraphs. Thanks for reading.

Natural World Under Threat: An Update on Earth’s Health

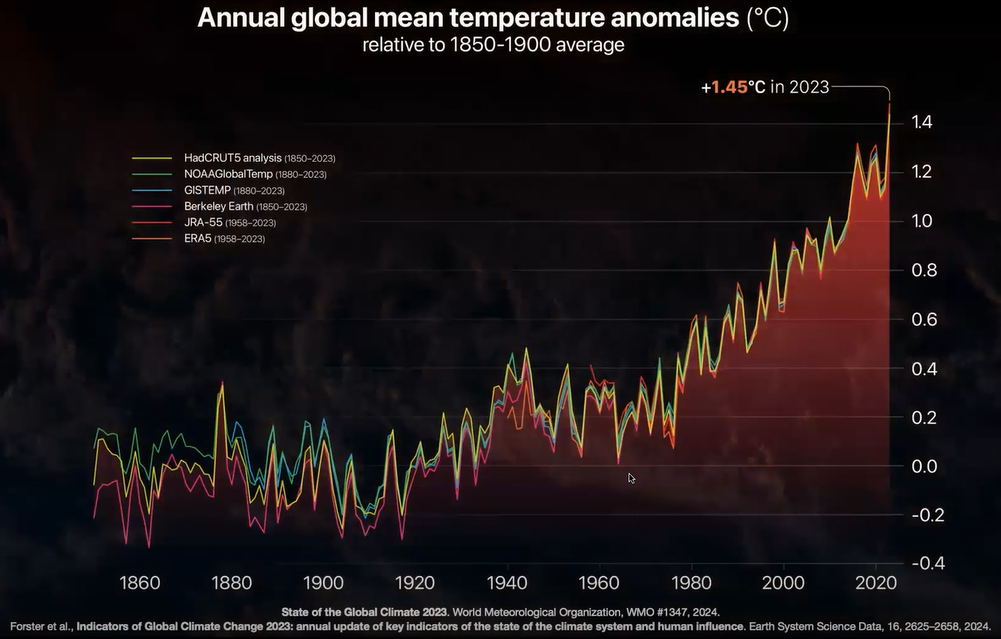

Global temperatures are rising at an unprecedented rate, with the past decade exhibiting signs of accelerated warming. Greenhouse gas emissions continue to rise globally, while we are also observing strain or saturation of critical natural sinks, including our forests and oceans.

Key indicators of these new concerning dynamics include skyrocketing sea surface temperatures, record-breaking ice mass loss, unprecedented air temperature increases, and extreme weather events amplified by a super El Niño effect, such as Hurricanes Helen and Milton this fall.

In short, we are breaking temperature records while witnessing the breakdown of natural systems which serve as buffers against additional warming, ushering us into a precarious new period for the Earth’s climate systems.

Despite these challenges, Johan emphasized that a window for action remains open. With immediate and exponential action (read: technological and societal innovation), the restoration of Earth’s systems and aversion of the worst outcomes is still possible. “The stakes are high, but so is the potential to secure a livable future,” he noted.

The State of the Energy Transition: An Investor’s Perspective

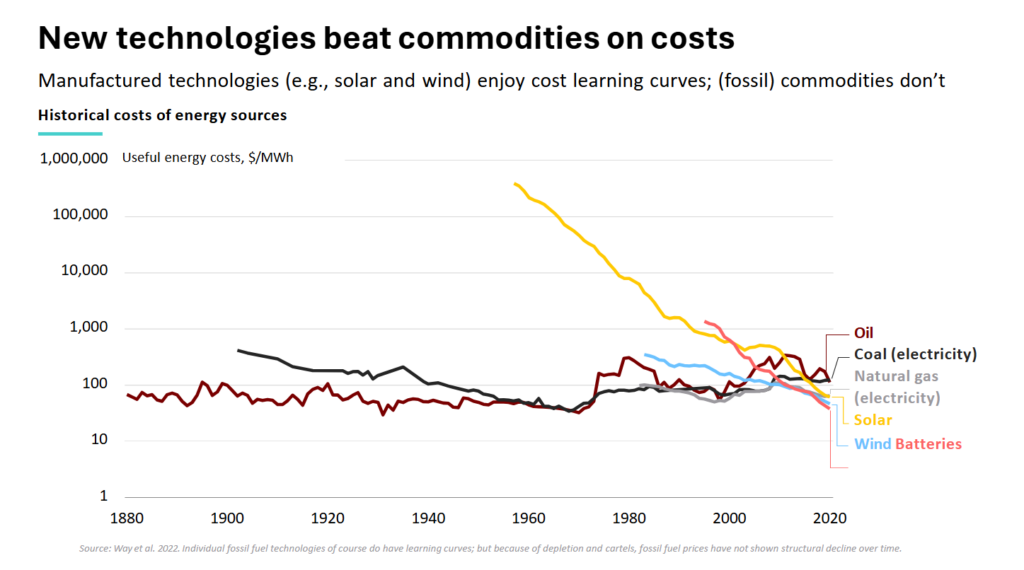

While our precarious climate and ecological situation should alarm folks, this is not a gloom-and-doom post. The energy transition is accelerating faster than most people realize, marking an inflection point of profound economic and geopolitical transformation. While traditional narratives would lead you to believe that the race to renewables is wholly dependent on policy support or who sits in the White House, as has historically been the case, ultimately, fundamental market dynamics are what drive lasting transitions. As an investor, if there is one thing I know to be true it’s that the power of economics, prices, and markets cannot be beat.

Cheaper, Faster, Better

Renewable energy technologies are outpacing fossil fuels in terms of cost, efficiency, and scalability. Solar and wind energy are now cheaper than fossil fuels, with costs declining every year due to industry learning curves. Fossil fuel demand has already peaked in the OECD in 2007 and is expected to peak in China in next 1-3 years. With renewable energy sources improving while fossil fuels stagnate with zero efficiency gain, the economic case for clean energy becomes increasingly compelling.

Data-Driven Accountability

Data plays a massively underappreciated role in driving the energy transition and there is now a global push to use emission and risk data to generate accountability that will impact how markets operate. We’re seeing this play out through initiatives like the EU’s Corporate Sustainability Reporting Directive (CSRD), as well as California’s climate accountability laws (SBs 253 and 261), which signal a new era of transparency.

Moreover, emission data is now becoming part of trade policy (i.e. the EU’s Carbon Border Adjustment Measures), illustrating that, critically, states now view climate as a matter of self-interest, not altruism.

Climate Risk as Financial Risk

Climate related costs aren’t decades away, they are adding up now. Premiums for properties in high-risk areas, such as Florida, have skyrocketed, rendering homeownership economically infeasible. Moreover, homeowners’ insurance is now an unprofitable business in 18 states due to risks from extreme weather. Exposure of the vulnerability of key economic assets only further amplifies the costs of inaction. These dynamics make climate risk a central consideration for investors, businesses, and governments.

Renewables as National and Economic Security

Climate policy has become energy policy, and to countries, energy is power. Southeast Asian nations, for example, are rapidly investing in domestic renewables to reduce reliance on unstable fossil fuel supply chains. In Vietnam, solar energy now accounts for 20% of total power generation—a meteoric rise from less than 1% just a few years ago.

Industrial policy in major economies, including the US and China, reflects the growing recognition that energy transition is critical to maintaining global competitiveness. While the incoming Trump Administration may threaten to rip up the IRA, in order to compete with China, the US will have to engage with energy at a national level (even if that means the rhetoric policy makers use is different). Moreover, reshoring manufacturing and leading on AI are core priorities for the Trump Administration, and both require massive amounts of energy.

The Power of Scientific and Market Tailwinds

The energy transition is at a critical inflection point. While climate science paints a dire picture of the risks posed by continued warming, the accelerating pace of technological innovation, and the factors securing its entrenchment, offer a compelling case for optimism.

There are many things I find worrying about the current state of the natural world. I spend too much time combing through the data; I allow it to keep me up at night. But I am also equally encouraged by how fast we are adapting, innovating, and scaling in global marketplaces.

So when I think about the scientific imperative Johan lays out, paired with the strengthening economic and technological fundamental of the energy transition, I absolutely see a gap between the overarching narrative in the US and where we are headed. While this worries me when I think about our planet and country, it also reminds me of a saying one of my mentors always used to tell me – the ignorance of others is a paycheck for you.