Sustainability-related disclosures

Sustainability-related disclosures pursuant to the European Commission’s Regulation (EU) 2019/2088 on Sustainable Finance Disclosure Regulation (“SFDR”)

I. Sustainability Risks

Pursuant to the SFDR, “sustainability risks” are defined as environmental, social, or governance (ESG) events or conditions that, if they occur, could cause an actual or a potential material negative impact on the value of an investment.

Galvanize LLC (“Galvanize”) is a climate-focused investment firm seeking to accelerate climate solutions and create long-term value for investors. As such, with respect to sustainability risks, Galvanize’s focus across its strategies will be more heavily weighted to sustainability risks related to climate impact.

Galvanize integrates sustainability risks in its decision-making process, in each case specific to the strategy’s investment processes. Sustainability risks form part of Galvanize’s risk evaluation and management process in connection with investment due diligence and portfolio management, in each case, in light of Galvanize’s evaluation of materiality to the investment and the circumstances of the investment (e.g., investment strategy, asset type, investment size, and stage of investment). Galvanize may elect to invest despite the existence of sustainability risks, such as where the sustainability risks may be mitigated or solved, or where such risks are determined to be immaterial or outweighed by other benefits.

II. Remuneration

The remuneration of team members is generally based on a combination of fixed and variable remuneration, which may be adjusted for performance. Galvanize encourages sound and effective risk management; however, we recognize that a willingness to take calculated risks is important to address the urgency of the climate crisis. With respect to senior investment professionals, investment performance may impact variable compensation via carried interest or incentive allocations. Sustainability risks may impact remuneration to the extent a material failure to consider sustainability risks adversely impacts investment performance.

Certain members of the team are also awarded carried interest, which may be based on performance or, in certain cases, achievement of sustainability metrics.

This document sets out sustainability-related disclosures for Galvanize Global Equities Fund (the “Fund”), a sub-fund of MontLake Oriel UCITS Platform ICAV (the “ICAV”), pursuant to the EU Sustainable Finance Disclosures Regulation (“SFDR”).

1. Summary

This section provides a summary of the website disclosures pursuant to the SFDR. It is provided for informational purposes only and, in the event of any inconsistency between this section and the website disclosures, the website disclosures shall prevail.

The Fund promotes an environmental characteristic but does not have as its objective sustainable investment. The environmental characteristic promoted by the Fund is the abatement of Green House Gas (“GHG”) emissions and climate change mitigation, i.e. curbing GHG emissions to reduce the amount of GHGs contaminating the atmosphere to meet the abatement required to meet the Paris Agreement targets (the “Transition”).

In order to achieve this, the Fund intends to invest in equities of companies across global equity markets, whose activities, the Investment Manager believes, will contribute to delivering the abatement in GHG emissions required to meet the Transition or whose activities will benefit from participation in the Transition.

The Investment Manager undertakes to understand and monitor portfolio companies’ abatement against net zero targets. The Investment Manager intends to place more emphasis on rates of change in portfolio companies’ carbon emissions against current emissions levels and on those companies’ long-term plans.

In order to evaluate the above, the Investment Manager will draw from research into a portfolio company’s practices, which may include a company’s annual filings, quarterly filings, sustainability reports, or third party research. In addition, the Investment Manager will draw from trusted ESG data sources such as Integrum ESG, MSCI and Bloomberg ESG, to create the Galvanize Climate Transition Score (the “GCT Score”) for each portfolio company that will form the basis for determining the extent to which each portfolio company is aligned with the goals of the Transition. Specifically, the Investment Manager refers to Integrum ESG (a licensee of SASB Inside and Minerva Analytics) and MSCI ESG Ratings to calculate the GCT Score. The scoring ranges from A1 to D4 with a score of A1 indicating a company has high transition alignment and environmental performance, whereas a D4 score would indicate a company has low transition alignment and environmental performance.

The proprietary composite score will help inform the transition risk assessment or alignment of each portfolio company, including the extent to which each portfolio company is aligned with the goals of the Transition and/or is on a trajectory consistent with any public commitment it has made in respect of the Transition, as well as the team’s level of conviction that they can engage with a company towards climate alignment to the extent engagement may be required.

Further detail on the Fund’s investment strategy is described below.

Galvanize LLC (the “Investment Manager”) intends to investment a minimum of 95% of the Fund’s net asset value in investments which are aligned with the environmental characteristics promoted by the Fund, of which 20% is planned to be invested in sustainable investments.

The Investment Manager undertakes to understand and monitor portfolio companies’ abatement against net zero targets. The Investment Manager intends to place more emphasis on rates of change in portfolio companies’ carbon emissions against current emissions levels and on those companies’ long-term plans.

Data sources used to attain environmental or social characteristics promoted may include both proprietary information and third party data providers as described in further detail below. Whilst it is recognised that data availability may impact the extent to which environmental or social characteristics promoted can be measured, this is managed through the use of both proprietary data and data sourced from third party data providers generally with broad capabilities and coverage.

The Fund’s engagement with select portfolio companies is expected to be an important element of the Fund’s strategy. The Investment Manager intends to make the Fund’s objectives and expectations clear to those portfolio companies early in the investment cycle. The Fund is expected to benefit from the Investment Manager’s insights on key aspects (commercial, technological, and regulatory) of the Transition and, therefore, is expected to be well placed to influence companies as they explore their own strategies and policies on these subjects. The Fund will seek to bring the Investment Manager’s resources and credibility to the table in order to catalyze change at select portfolio companies.

The Fund does not have a ‘Designated reference benchmark’ to attain the environmental or social characteristics promoted.

2. No Sustainable Investment Objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment.

3. Environmental or social characteristics of the financial product

The environmental characteristic promoted by the Fund is the abatement of GHG emissions and climate change mitigation, i.e. curbing GHG emissions to reduce the amount of GHGs contaminating the atmosphere to meet the Transition.

The Fund does not have a reference benchmark designated for the purpose of attaining the environmental or social characteristics promoted.

4. Investment Strategy

4.1 What is the investment strategy used to meet the environmental or social characteristics promoted?

The Investment Manager intends to drive the Fund’s returns by investing in equities of portfolio companies across global equity markets that the Investment Manager believes will either directly benefit from their participation in the energy transition contemplated under the Paris Agreement, or whose activities the Investment Manager believes will contribute to delivering the abatement required to meet the Transition. While the Investment Manager will seek to manage the Fund based on a “double bottom line” which consists of taking into account both pure economic performance and alignment with the goals of the Transition, the Investment Manager believes that portfolio companies aligned with the Transition will reap significant economic rewards in our rapidly changing world and generate long-term capital growth for the Fund.

The Fund will be actively managed through a combination of fundamental equity research organized according to sector exposures and Transition pathways. The Fund’s portfolio is expected to be diversified across industries and geographies, with no particular geographic focus intended. The average investment horizon (i.e., the length of time for which an investment will be held) is expected to be three years.

The Investment Manager expects that portfolio companies should display some or all of the following attributes:

- Public Commitment – company management will have identified publicly that the Transition is a major part of the portfolio company’s strategy;

- Capital Allocation – a significant portion of new capital will be allocated towards Transition aligned activities; and

- Ripple Effect – impact will be amplified by actions to influence supply chain and customer behaviour to enhance societal Transition alignment.

In managing the Fund, the Investment Manager intends to engage with select portfolio companies to accelerate and support the Transition. The Investment Manager may also seek to collaborate with portfolio companies to enable them to measure, disclose, and target carbon emissions. In particular, the Investment Manager believes that adopting Scope 3 measures and targets (i.e. measures and targets that aim to reduce indirect emissions that occur in a company’s value chain) is a necessary mechanism to enforce alignment throughout the value chain. In selected cases, the Fund also intends to advocate for change of capital allocation policies and corporate strategy to deliver enhanced financial return and accelerated GHG abatement. The Fund will also aim to harness the resources of the Investment Manager’s eco-system to deliver impact at portfolio companies.

The Investment Manager believes that aspects of the Transition will evolve over time, and that the Investment Manager’s investment universe and the processes it uses to identify investments will also evolve. However, the Investment Manager intends for the Fund’s investments to always be aligned with the goal of addressing the effects of global warming.

The Fund generally intends to segment the investable universe of potential portfolio companies into three categories based on their Transition characteristics.

- Transition Franchises are scaled, market-leading companies that the Investment Manager believes can offer sustainably high returns on capital, strong alignment to the Transition in capital allocation and accelerating top line growth in these activities.

- Transition Improvers are companies with an important role to play in the Transition and that are early in their journey of adaption. Transition Improvers include companies with significant emissions in their operational activities, large Scope 3 footprints that need addressing and legacy companies attacking the opportunity of the Transition with significant capital allocation to new business lines that have not yet scaled. When investing in Transition Improvers, the Fund will seek to influence the speed and ambition of this improvement by bringing the resources of the Investment Manager to bear in order to deliver rigorous, informed and constructive engagement intended to have an impact on the corporate outcome.

- Transition Enablers are companies that the Investment Manager believes are allocating (or will allocate) a significant portion of their capital towards services, technologies or products specifically intended to deliver the Transition. Transition Enablers will typically exhibit faster growth and less maturity in their profit path – and so may present greater investment risk – but will be attacking a very large addressable market with an innovative approach to delivering carbon abatement. The Fund will also include renewable developers in this category. The Investment Manager believes that its science team’s domain expertise will prove a crucial, differentiating resource when evaluating companies in this category.

4.2 What is the policy to assess good governance practices of the investee companies?

The Investment Manager will assess governance factors for each portfolio company based on third party data, from providers such as Minerva Analytics and Bloomberg ESG. Specifically, the team reviews industry-accepted ratings that incorporate governance considerations as part of the vetting process for potential investments.

Governance considerations include: (i) sound management structures; (ii) employee relations; (iii) remuneration of staff; and (iv) tax compliance (including penalties, fines or other liability arising from breaches of applicable tax law).

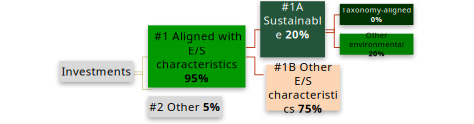

5. Proportion of Investments

95% of the planned asset allocation of the Fund will fall within category #1 “Aligned with E/S characteristics”, of which, 20% is planned to be sustainable investments falling within category #1A “Sustainable”. The remaining 5% of the Fund is expected to fall within category #2 Other.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

The category #1 Aligned with E/S characteristics covers:

– The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

– The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

As at the date of this disclosure, the Fund does not commit to invest in any “sustainable investments” within the meaning of the Taxonomy Regulation. The minimum share of investments in transitional and enabling activities within the meaning of the Taxonomy Regulation is therefore set at 0% of the Fund’s Net Asset Value.

6. Monitoring of environmental or social characteristics

The Investment Manager undertakes to understand and monitor portfolio companies’ abatement against net zero targets. The Investment Manager intends to place more emphasis on rates of change in portfolio companies’ carbon emissions against current emissions levels and on those companies’ long-term plans.

With respect to each portfolio company, the Investment Manager intends to periodically monitor such company’s abatement against net zero targets and periodically update the proprietary composite score to reflect relevant changes. Notably, some of the Fund’s portfolio companies, particularly those in the Transition Improvers category, may be relatively large generators of greenhouse gas emissions, at least at the time of an initial investment. In addition, the Investment Manager may hold investments in portfolio companies that fail to meet stated emissions targets, or which have revised and/or extended their deadlines to achieve those targets.

7. Methodologies for environmental or social characteristics

The Investment Manager undertakes to understand and monitor portfolio companies’ abatement against net zero targets. The Investment Manager intends to place more emphasis on rates of change in portfolio companies’ carbon emissions against current emissions levels and on those companies’ long-term plans.

In order to evaluate the above, the Investment Manager will draw from research into a portfolio company’s practices, which may include a company’s annual filings, quarterly filings, sustainability reports, or third party research. In addition, the Investment Manager will draw from trusted ESG data sources to create a proprietary composite score for each portfolio company.

This proprietary composite score will help inform the transition risk assessment or alignment of each portfolio company, including the extent to which each portfolio company is aligned with the goals of the Transition and/or is on a trajectory consistent with any public commitment it has made in respect of the Transition, as well as the team’s level of conviction that they can engage with a company towards climate alignment to the extent engagement may be required.

8. Data sources and processing

The ESG indicators used to measure attainment of the environmental and social characteristics promoted by the Fund are drawn from third-party data sets overseen by the Investment Manager.

- Integrum ESG, MSCI and/or Bloomberg ESG are used to form the basis for determining the extent to which each portfolio company is aligned with the goals of the Transition.

- The Investment Manager specifically refers to Integrum ESG (a licensee of SASB Inside and Minerva Analytics) and MSCI ESG Ratings to calculate the GCT Score.

- The Investment Manager uses third party data, from providers such as Minerva Analytics and Bloomberg ESG to assess governance factors for each portfolio company.

- The Investment Manager refers to Integrum ESG, a leading independent ESG data analyst and provider, which uses research and frameworks of leading organisations, including the impact framework developed by the University of Cambridge Institute for Sustainability Leadership (2019) “In search of impact: Measuring the full value of capital. Update: The Sustainable Investment Framework” to score a company’s alignment with the UN Sustainable Development Goals.

To ensure data quality, the Investment Manager’s investment team reviews its work to identify reputable data providers, such as industry-accepted ratings methodologies, research, and analysis. In addition, where appropriate, the investment team may leverage the Investment Manager science team’s domain expertise to help evaluate and digest data.

The Investment Manager will draw from the data sources listed above, to create a proprietary composite score for each portfolio company.

The Investment Manager may use both reported and estimated data in its evaluations, which includes reported and estimated data from portfolio companies and third party data providers. The proportion of data that is estimated will vary depending on the individual portfolio company and data sources available. For example, Scope 3 emissions data is often difficult to measure and therefore may often be estimated.

9. Limitations to methodologies and data

In making investments decisions, the Investment Manager will conduct inquiries and undertake due diligence that it considers appropriate under the particular circumstances of those decisions. It will attempt to evaluate complex business, financial, tax, accounting, environmental and legal issues and will seek information to allow it to do so. The Investment Manager will rely on the resources reasonably available to it, and, in particular, will rely heavily on the accuracy and completeness of information provided by third parties. However, often it will not be in a position to confirm that completeness or accuracy: particularly in the face of fast-moving developments, critical, and apparently reliable, information may be inaccurate or incomplete. The Investment Manager’s due diligence inquiries may not reveal or highlight matters that could affect its decision making, and its evaluation of information it does have may be flawed, with potentially material adverse effects on the Fund’s portfolio and the value of its investments.

10. Due Diligence

The Investment Manager utilizes (a) primary and secondary research, (b) analyst sector, industry and geographic expertise and (c) industry-accepted ratings methodologies as part of the vetting process for potential investments.

The investment team performs due diligence using some or all of the following: primary contact with companies, competitors and suppliers; third-party confirmations via industry experts; and interaction with investment banking analysts, other participants in the companies’ ecosystems and resources at the Investment Manager.

In addition, the team reviews a company’s annual filings, quarterly filings, and/or sustainability reports. With this information, the Investment Manager analysts review the company’s progress on its decarbonization commitments, if any.

11. Engagement Policies

The Investment Manager’s engagement with select portfolio companies is expected to be an important element of the Fund’s strategy. The Investment Manager intends to make the Fund’s objectives and expectations clear to those portfolio companies early in the investment cycle. The Fund is expected to benefit from the Investment Manager’s insights on key aspects (commercial, technological, and regulatory) of the Transition and, therefore, is expected to be well placed to influence companies as they explore their own strategies and policies on these subjects. The Fund will seek to bring the Investment Manager’s resources and credibility to the table in order to catalyze change at select portfolio companies.

The framework used to select and engage with potential portfolio companies will also draw from multiple resources, including company sustainability reports, company interactions, ESG analytics tools and other data provider analytics selected by the Investment Manager at its discretion. Using these sources, the Investment Manager will form a composite score, the GCT Score for each portfolio company that will form the basis for determining the extent to which each portfolio company is aligned with the goals of the Transition. Specifically, the Investment Manager refers to Integrum ESG (a licensee of SASB Inside and Minerva Analytics) and MSCI ESG Ratings to calculate the GCT Score. The scoring ranges from A1 to D4 with a score of A1 indicating a company has high transition alignment and environmental performance, whereas a D4 score would indicate a company has low transition alignment and environmental performance. Integrum ESG is an ESG software provider which uses its own “Sovereign ESG Assessment Framework” to assess ESG performance using a focused set of metrics that are informed by data from reputable, international non-profit organisations.

When the Investment Manager engages with a portfolio company, the Investment Manager expects to do so along some or all of the following dimensions:

- Measure, disclose and target carbon emissions – for relevant portfolio companies, the Fund will have a set of “asks” relating to disclosures and GHG targeting using industry frameworks such as the Task Force on Climate Related Financial Disclosures (“TCFD”) and the Science Based Targets Initiative (“SBTi”) (or others that may be developed in the future) to guide corporate behaviour. The TCFD develops recommendations on the types of information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing a specific set of risks related to climate change. The SBTi is a corporate climate action organisation that enables companies and financial institutions worldwide to play their part in combating the climate crisis.

- Advocate for change of capital allocation policies and corporate strategy – for select investments in the Fund’s portfolio, the Investment Manager will seek to have more direct influence on capital allocation to accelerate the Transition. This may include working to persuade certain portfolio companies to reduce their allocations to polluting activities and/or increase allocations to remedies/adaption. The Investment Manager may also seek to advocate for changes to certain portfolio companies’ corporate governance, including proposals to adjust executive compensation policies to reward the delivery of abatement. The Investment Manager will aim to collaborate with portfolio companies rather than fight proxy battles.

12. Designated Reference Benchmark

No index has been designated as a reference benchmark to meet the environmental or social characteristics promoted by the Fund.

FUND: Galvanize Global Equities Fund (the “Fund”)

LEI: 635400ENZRFLPGQJRQ80

ISIN: N/A

MANAGEMENT COMPANY: Waystone Management Company (IE) Limited (the “Manager“)